- UGREEN

- Posts

- COP30 approves principles for "interoperability" of taxonomies. Brazil and its hostile architecture

COP30 approves principles for "interoperability" of taxonomies. Brazil and its hostile architecture

Your UGREEN News is live!

News

COP30 approves principles for taxonomy “interoperability” and targets unlocking capital for the Global South

Photo: Isabela Castilho/ COP30 Brasil Amazônia

COP30, held in Belém, Brazil, marked a technical advance in the sustainable finance agenda by launching the Principles for Taxonomy Interoperability, developed under the Taxonomy Roadmap Initiative (TRI). The measure aims to reduce the regulatory fragmentation created by the expansion of national and regional taxonomies—now more than 50 in force or under development—which has increased transaction costs and generated legal uncertainty for international investments.

The announcement positions interoperability as a mechanism to improve comparability across different countries’ rules while preserving space for local priorities. In practical terms, the proposal seeks to facilitate the recognition of sustainable assets across jurisdictions and reduce barriers to the entry of institutional private capital into emerging economies.

What was announced

The package approved in Belém establishes seven principles to guide the creation and updating of taxonomies:

Jurisdictional priorities and best practices as the foundation of taxonomy design;

Common design and terminology, including sector classifications and the structure of Technical Screening Criteria (TSC);

Defined use cases and users from the outset (banking regulation, securities, public procurement, among others);

Regular reviews and expansion, incorporating transition activities and new technologies;

Science-based criteria, with quantitative metrics to reduce subjectivity;

Market signaling and “ownership,” with private sector engagement and pilot projects before full adoption;

International collaboration and mutual recognition, with a focus on equivalence across frameworks.

The outcome consolidates a strategic shift: the initial idea of a single “Super Taxonomy” has been replaced by a model of functional interoperability, designed to allow different taxonomies to “communicate” without imposing a single global standard.

Tool to operationalize interoperability

Alongside the principles, the Sustainable Finance Taxonomy Mapper was launched—a digital tool designed to compare how different taxonomies define activities, objectives, and technical thresholds. The goal is to enable issuers and investors to identify convergences and divergences, allowing them to structure transactions compatible with multiple markets.

Focus on financing Africa

The initiative was presented as particularly relevant for developing countries, especially the African continent, which faces an estimated annual financing gap of USD 190 billion to meet its Nationally Determined Contributions (NDCs).

The assessment accompanying the announcement indicates that Africa continues to have a limited share of the global sustainable debt market: less than 1% of global green bond issuances and just 0.3% of the total value issued. The cost of capital for clean energy projects on the continent was also described as two to three times higher than in advanced economies, partly due to risk perception and the lack of standardization and comparable data.

In terms of use of proceeds, African issuance is described as concentrated in “mixed” projects (mitigation and adaptation), while purely adaptation-focused projects account for 7% of total volume, despite being considered critical for the continent’s resilience.

Continental taxonomy and the case of Kenya

The Belém initiative takes place in parallel with the consolidation of African instruments.

African Sustainable Finance Taxonomy

In July 2025, the continent advanced with the validation of an African taxonomy supported by the African Development Bank (AfDB) and the African Financial Alliance on Climate Change (AFAC). The framework emphasizes adaptation and resilience, incorporates social safeguards, and addresses natural gas as a transition element under limits and conditions aligned with the Paris Agreement.

Kenya Green Finance Taxonomy (KGFT)

In April 2025, the Central Bank of Kenya launched the first edition of the KGFT, structured around three tests: Substantial Contribution, Do No Significant Harm (DNSH), and Minimum Social Safeguards. The taxonomy was accompanied by a climate risk disclosure framework for banks, with an 18-month transition period, and was presented as a tool to make local projects more “readable” to external investors.

Open issues

Despite the progress, the framework approved in Belém retains limitations highlighted in the debate itself:

Voluntary adoption: there is no enforcement mechanism for non-adoption or inconsistent application;

Capacity and data: implementation depends on technical and historical climate data that are not always available at the project level;

Just transition: operational definitions and social indicators remain contested and subject to the risk of superficial application.

Next test: COP32 in 2027

With Ethiopia confirmed as the host of COP32 in 2027, expectations for the post-Belém cycle focus on practical verification—whether interoperability and national and regional instruments will reduce transaction costs, increase liquidity, and, most importantly, lower the cost of capital for adaptation, resilience, and clean energy projects across the African continent.

UGREEN

Make 2026 the year that transforms your career with the UGREEN Sustainable Shift

The market is changing fast—and those who master sustainable practices now have a real competitive advantage.

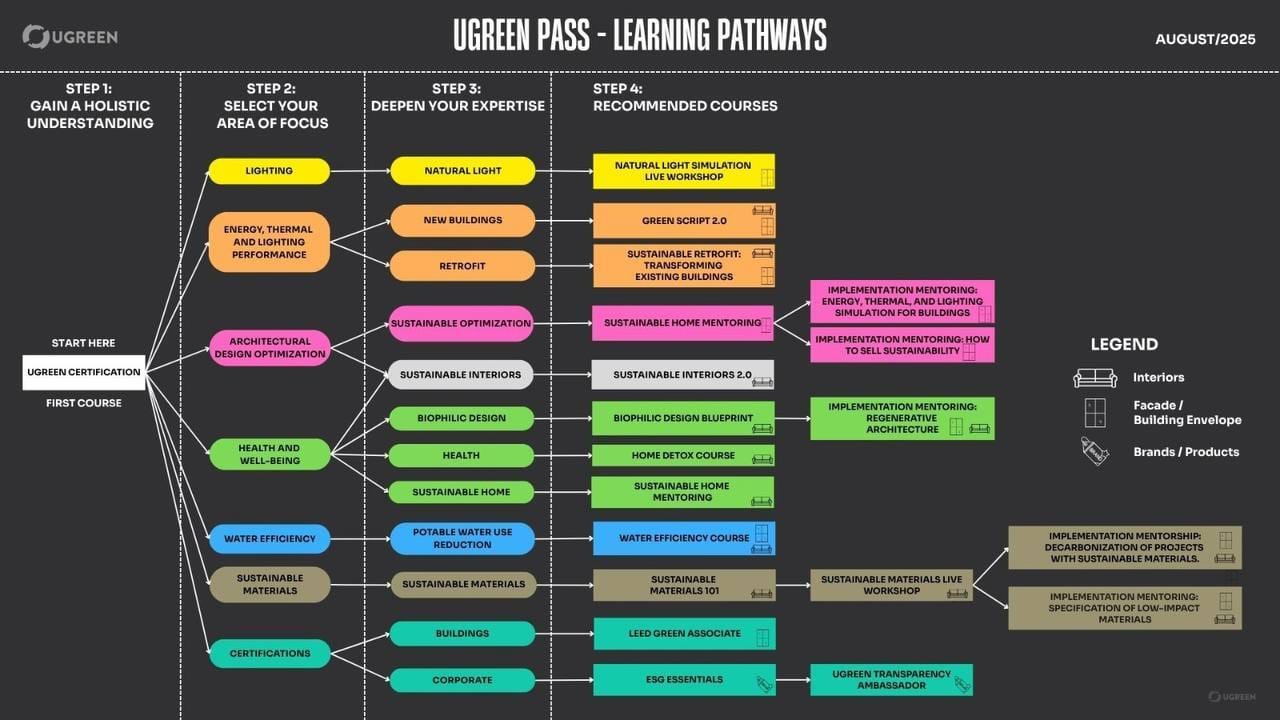

With the UGREEN Sustainable Shift, you gain access to complete specialization learning paths, designed for professionals who want to position themselves strategically in the construction sector and create real impact through their projects.

What you unlock with this special offer

Lifetime access to ALL UGREEN learning tracks, including:

Lead the sustainable transformation with the UGREEN Sustainable Shift!

2026 has already begun, and the transformation that architecture and engineering need is already underway.

👉 So, will you let this opportunity pass?

Video

Hostile Architecture in Brazil: cities designed to exclude

Brazilian cities are not neutral. Their public spaces have been historically shaped by social, economic, and political disputes. The way streets, sidewalks, and urban furniture are designed reflects decisions that go beyond aesthetics or technical standards, revealing concrete strategies of control and exclusion.

So-called “hostile architecture” is a direct example of this. It refers to the intentional use of physical design elements that prevent vulnerable populations—especially people experiencing homelessness—from fully using public space.

These devices, such as divided benches, rocks placed under overpasses, or metal obstacles, are not accidental. They are designed, funded, and maintained with a clear purpose: to protect the market value of certain areas, even if that means restricting basic rights such as resting, shelter, or simply being allowed to stay.

Brazilian legislation already recognizes this practice as incompatible with constitutional principles such as human dignity and the social function of the city. Even so, hostile architecture remains present—often disguised as landscaping, “revitalization,” or urban modernization.

Want to dive deeper into this topic?

Watch the full video on YouTube to understand how this practice works, its historical roots, and its social, legal, and environmental impacts.

Disclaimer: The video is in Brazilian Portuguese, but simultaneous translation and subtitles are available in multiple languages.

Reply