- UGREEN

- Posts

- Norway surges ahead in the electric vehicle race. The US intervention in Venezuela in details.

Norway surges ahead in the electric vehicle race. The US intervention in Venezuela in details.

Your UGREEN News is live!

News

Norway ended 2025 with 96% of new car sales being electric

Credits: Mobility Portal Europe

By the end of 2025, Norway reported that 95.9% of all new passenger cars sold in the country were battery electric vehicles (BEVs). In December, this figure reached 97.6%, according to data from the Norwegian Road Traffic Information Council (OFV). The combined share of gasoline and diesel vehicles fell to just 1.3%, making the internal combustion engine virtually irrelevant in the new car market.

The target set by the Norwegian Parliament in 2017 established that, from 2025 onward, all new vehicles sold should be zero-emission. Although there was no legal ban, the goal was achieved through consistent fiscal and regulatory policies implemented over several decades.

Economic and fiscal factors influenced the anticipation of purchases

December saw an unusually high concentration of sales, driven by the anticipation of budgetary changes scheduled for 2026. The main change was the reduction of the VAT exemption threshold from NOK 500,000 to NOK 300,000. This adjustment increased the final price of mid- and high-end electric vehicles by approximately NOK 50,000.

As a result, demand shifted from the first quarter of 2026 to the last quarter of 2025, partially distorting December sales data. Analysis of consumer behavior indicates that purchasing decisions were driven primarily by economic factors rather than ideological considerations.

Tesla retained leadership; Chinese brands expanded their market share

Once again, Tesla was the automaker with the largest market share for the fifth consecutive year, accounting for 19.1% of sales. The Model Y was the best-selling car in Norway in 2025. Volkswagen and Volvo ranked second and third, respectively.

Chinese brands such as BYD, MG, and Xpeng increased their combined market share to 13.7%, benefiting from the absence of import tariffs. As Norway is not part of the European Union’s customs union for automobiles, it has maintained a more open market for these manufacturers.

Fiscal policy and incentives shaped the current landscape

Since the 1990s, Norway has implemented tax incentives for electric vehicles. These incentives included:

Exemption from import and purchase taxes;

Exemption from 25% VAT;

Operational benefits such as access to bus lanes, free or reduced parking, and exemption from tolls.

Starting in 2023, the government began a gradual reduction of these subsidies. In 2026, measures implemented included:

Reduction of the VAT exemption to the first NOK 300,000;

Introduction of a weight-based tax on electric vehicles;

Full application of the annual vehicle circulation tax.

The objective of these changes is to recover lost tax revenues, estimated at NOK 50 billion per year, and to avoid regressive distortions in the tax system.

The national fleet already reflects the structural shift

In December 2025, the electric vehicle fleet surpassed the diesel vehicle fleet in Norway for the first time:

Electric vehicles: 31.78% of the fleet;

Diesel vehicles: 31.76%;

Gasoline vehicles: 23.9%.

The fleet renewal rate is estimated at between 5% and 7% per year. This indicates that the share of electric vehicles will continue to grow, pointing toward a progressive replacement of internal combustion vehicles.

Charging infrastructure meets new demand

Norway has more than 10,000 fast chargers (DC). The country has the highest density of public chargers in Europe, with more than 400 per 100,000 inhabitants. Approximately 90% of fast chargers operate at power levels of 150 kW or higher.

The expansion of infrastructure has eliminated logistical bottlenecks during periods of peak demand. In addition, legislation guaranteeing the right to install charging points in multi-family residential buildings has facilitated the adoption of home charging, which accounts for the majority of charging activity.

Fossil fuel consumption continues to decline

Between 2021 and 2024, gasoline and diesel consumption in Norway fell by approximately 12%, with an additional 6.47% reduction between 2023 and 2024. According to Statistics Norway (SSB) data, fleet electrification is directly linked to this decline.

The national power grid, supplied almost entirely by hydropower, absorbed the increased demand without instability. The next major technical challenge will be electrifying heavy transport.

Political framework enabled regulatory stability

The success of Norway’s energy transition is closely linked to the consistency of public policies, which have been implemented steadily by different governments over several decades. Political support for electrification has been maintained despite changes in governing parties.

The absence of a domestic automotive industry also reduced opposition to the transition. In addition, the large-scale availability of renewable energy made electrification a defensible policy from both an economic and strategic perspective.

UGREEN

The UGREEN Sustainable Shift is what your career needs for 2026!

Start the year leading the sustainable transformation. Spots are already filling up, act fast!

You know it was a success. And if you’re not part of it yet, this is your perfect opportunity.

All spots were filled quickly, and we realized many professionals are still looking to join this movement.

That’s why we’ve opened a new opportunity to secure:

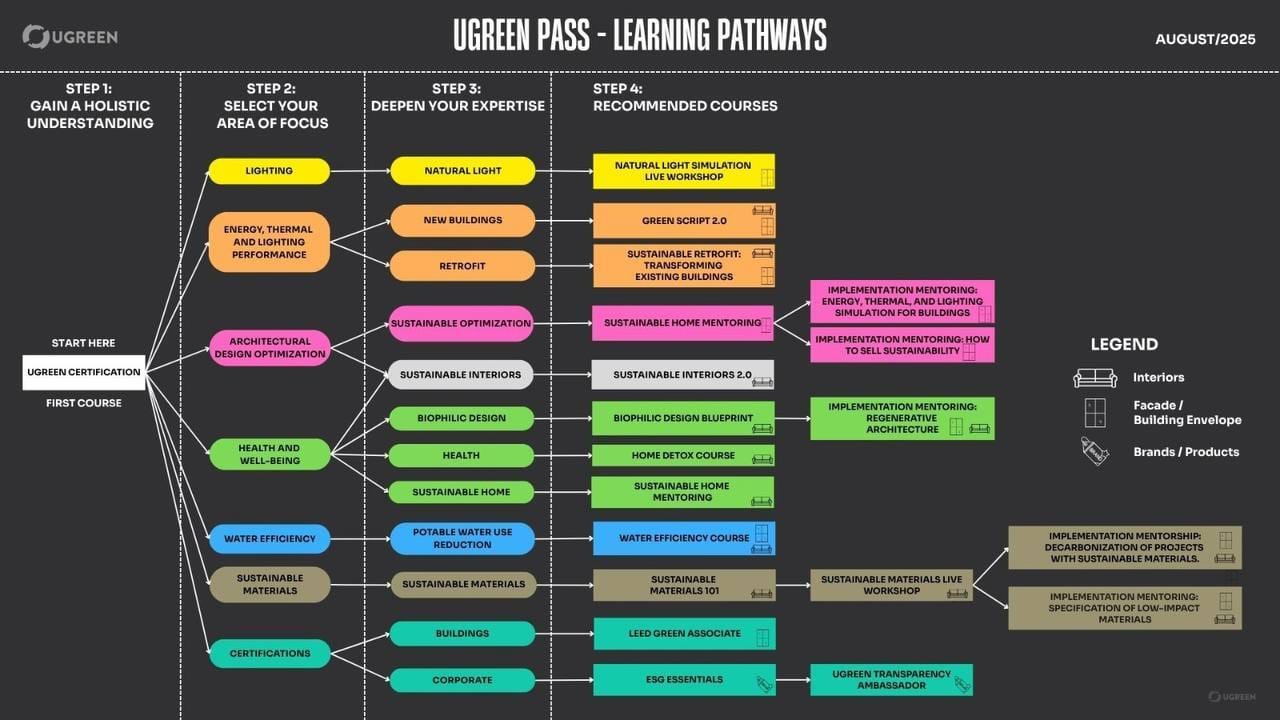

Lifetime access to ALL UGREEN courses;

All courses for the price of one;

Complete learning paths (so you know exactly what to study and in what order).

The UGREEN Pass was created for those who want to turn sustainability into a real business advantage.

With it, you’ll learn how to:

Sell projects using data (not opinions);

Charge more by delivering efficiency;

Work with retrofitting and sustainability certifications;

Position yourself as a recognized specialist.

See below how many courses you’ll unlock:

👉 There’s still time to transform your career for 2026!

Video

U.S. intervention in Venezuela: resources, power, and real consequences

The dispute between the United States and Venezuela involves structural factors and cannot be treated as an isolated conflict. The focus lies on control over the largest proven oil reserves in the world, located in the Orinoco Belt, a region that is strategic for global energy supply.

In recent years, economic sanctions and indirect interventions have created a scenario of productive collapse in Venezuela. The reduction in domestic production, the deterioration of infrastructure, and shortages of basic inputs are direct consequences of this process.

At the same time, U.S. companies have continued to access Venezuelan oil, even under declared blockades. This highlights contradictions between political rhetoric and economic interests.

The crisis also has significant environmental impacts. The increasing use of clandestine routes and aging vessels for oil transport raises the risk of ecological disasters in the Caribbean region. In addition, the expansion of mining into forested areas is intensifying the destruction of sensitive ecosystems.

This combination of geopolitical, economic, and environmental interests creates a scenario of prolonged instability, with direct impacts on Brazil, which has been a destination for thousands of Venezuelan migrants in recent years.

Want to understand how these elements are connected?

Watch the full video on the topic and explore the details of U.S. intervention in Venezuela.

Disclaimer: The video is in Brazilian Portuguese, but simultaneous translation and subtitles are available in multiple languages.

Reply